#Budget planning in excel free#

The app also provides personal support, including free live Q&A sessions offered weekly. It helps you spend smarter with tools like budget creation, goal tracking, and reports (including visual graphs and charts). YNAB is ideal for people who have debts to pay off or savings goals they want to reach. Mint: Which Budgeting App is Better?” to provide more details. Not sure which budgeting app is for you? I break it all down in this article “YNAB vs. If you like the convenience of all of your financial planning tools in one place, Mint is a solid choice. You can connect all of your bank accounts, including investments, so you have a quick financial picture at hand. You can track spending, monitor subscriptions, create custom budgets, and more. If you like having all of your financial data in your hand, Mint is worth a look. Automation is a great psychological trick to help you gain control of your finances. You can also automate payments, for example, by putting away a set amount of cash every month to save money. Most banks provide apps that link to your checking account and credit card, allowing you to automatically track expenses. Start by making the most of any features your bank offers. Here are some of the best budgeting apps to help automate money management, giving you more control over your cash so you can meet your financial goals while thinking about them less. Again, look to simple technology to streamline your efforts, saving you time and energy. Budgeting apps and tools can then help you put that plan into action. Using the tools above, you can craft a conscious spending plan.

My 2 Favorite Budgeting Apps and Tools to Help with Money Management

#Budget planning in excel how to#

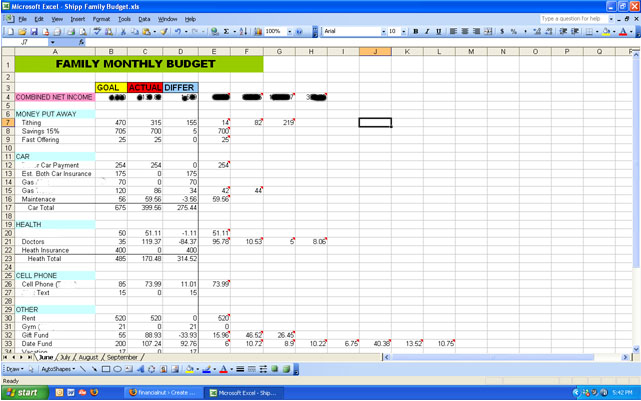

The formula at the end (subtracting expenses from income) provides a picture of your financial health and can help you figure out how to better manage your money.

#Budget planning in excel pdf#

The free budget spreadsheet is available to download as a PDF and provides a list of proposed income and expense budget categories - you just have to fill in the dollar amounts. The Federal Trade Commission (FTC) offers another handy budgeting tool. The Federal Trade Commission’s budget worksheet There are also budget calculators to help you stick to your selected budgeting rule, like the 50/20/30 rule (which dictates that 50% of your budget goes to essential fixed and variable expenses, 20% goes to savings and debts, and 30% goes to the rest). If you have a Google account, you can access free templates covering weekly, monthly, and annual budgets. Google Sheets offers another budgeting method. If you have the Microsoft Office suite, you can access these Excel templates for free. There are even specialty templates, such as a personal monthly budget, a college budget, a home construction budget, and an event planning budget. These free budget templates are an easy way to get an overview of your cash flow (monthly expenses versus monthly income). Microsoft Excel isn’t all about complex formulas. The aim is to use tools that allow you to devote fewer hours to your money management. When it comes to budget templates, it’s best to keep them simple, and there are many user-friendly tools available to save you time and stress. Does this mean you need to master complex financial formulas? Not at all. The thought of creating a budget spreadsheet can be intimidating. But, it doesn’t have to be! I spoke with a couple in episode 114 of my podcast about how a big income lead to big debt.ģ Budget Spreadsheet Templates to Get You Started The entire point of these tools is to simplify money management so you can think about your money less, not more.įor many people, budgeting and planning for big expenses like vacation are a struggle. Then, you can use a budgeting app to help you stick to it, for example, by automating your expense tracking. Straightforward spreadsheets can help you create your conscious spending plan.

Finally, you need to stick to your plan.īudgeting spreadsheets and tools can help you every step of the way. You then need to decide how much money to allocate to each bucket. You need to start with a bullet-proof budget, categorizing all of your expenses into one of those four buckets: fixed costs, investments, savings, and guilt-free spending. Conscious spending is a great way to enjoy life while still building a financially secure future.

0 kommentar(er)

0 kommentar(er)